"Currently, there has been a rather strong cooling in the industrial real estate market. Demand is mainly driven down by logistics, the situation is at least partly saved by demand associated with production, where the so-called nearshoring trend continues, mostly in the automotive industry or production linked to green technologies. Companies are now focusing more on the flexibility of their supply chains and the ability to respond quickly to changes in customer demand and component supply. All this becomes a crucial factor for deciding on the location of industrial facilities and warehouses," says Petr Narwa, Head of Transaction & Consulting Services at Prochazka & Partners.

The demand for industrial real estate was so high in previous years that it paid off for industrial developers to increase the share of so-called speculative construction. This means that the premises will begin to be built without their tenant being known in advance, but the landlord believes that he will be able to find a tenant by the end of construction. This has done well in recent years, but the combination of reduced demand and a higher speculative build ratio of around 40% means that an increasing number of ready-made halls are starting to appear on the market that are still available.

While this is not an ideal situation for developers, it is good news for tenants, who will have more options and flexibility. Currently, about 600,000 square meters are being built speculatively, a large part in less attractive locations such as Karlovy Vary and Ústí Region or, for example, Ostrava. Such a size of speculative construction is already starting to affect the vacancy rate, which is logically slowly starting to rise from its record lows.

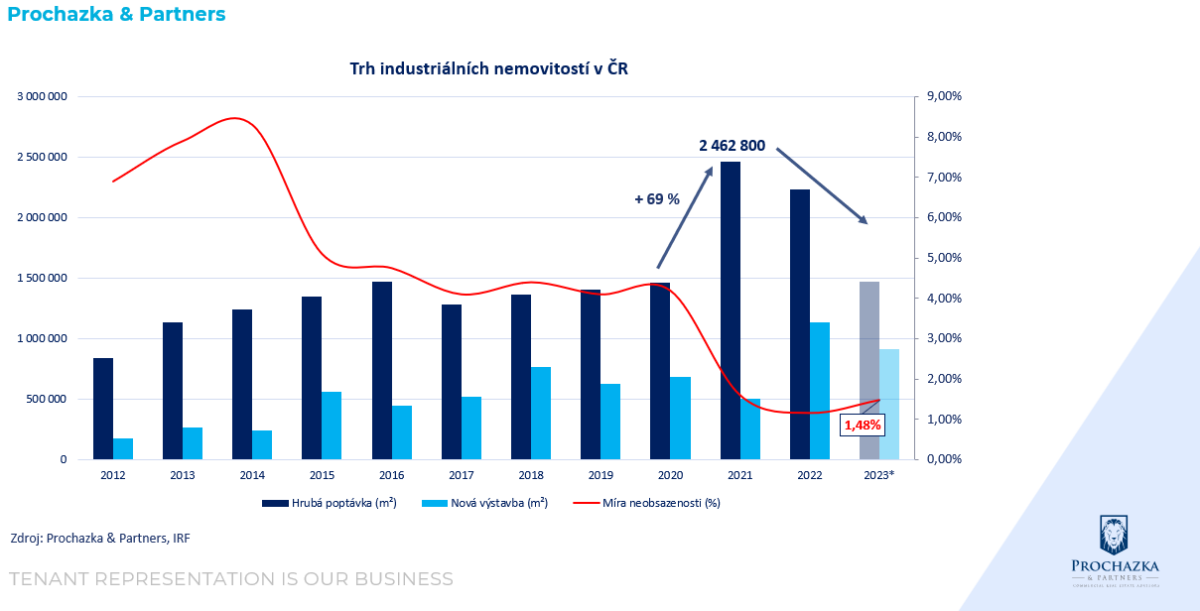

Industrial market demand

Industrial real estate market demand, along with new construction and vacancy rates

Rent reduction outside premium locations

“As more space becomes available, this is particularly good news for the commercial real estate tenants we represent. The pressure to reduce the rent is growing, not only nominally, but also effectively, i.e. after taking into account the increasing incentives and discounts from landlords. It won't have such a major impact on premium locations around Prague, Brno and Pilsen, but less attractive locations that have recently been riding the wave of rising rents, but there will be a more significant drop in prices," adds Narwa.

If we look at investments in commercial real estate, in the Czech Republic, despite the apparent decline in activity, the situation is not as bad as in the rest of Central and Eastern Europe. While we see a year-on-year decrease of around 30%, in the other states of the region it is more like between 60-70%. For example, they have problems in neighboring Poland, which is much more dependent on foreign capital than we are. In a situation where foreign investors are solving problems in their domestic markets, they logically do not want to invest so much in - from their point of view, riskier - Central and Eastern Europe. Therefore, those advisory firms for which commissions from investment transactions are key are not experiencing the best of times. This can also be seen in the departure of established multinational brands from the Czech market, when consulting brands JLL and BNP Paribas Real Estate left the Czech Republic.